Frequently Asked Questions

What is a UK Freeport?

UK Freeports (Green Freeports in Scotland) are special areas that have been created by the Government to increase investment in parts of the country that have historically missed out. They benefit from a generous package of tax and customs incentives, as well as excellent port infrastructure, and build on the proud industrial heritages of their regions.

All of this enables UK Freeports to create an attractive business environment with the aim of rebalancing local economies by building new clusters (groupings) in industry sectors, supporting our journey to Net Zero, and creating thousands of high-quality jobs for local people.

Any location in a UK Freeport is subject to the same laws and regulations as the rest of the country.

Find out more about the UK Freeport Programme and where they are located on the UK Freeports website.

How does the PASD Freeport benefit the local area?

Our Freeport is predicted to create over 3,500 quality jobs for the local economy. By helping to address the local skills gap with our local partners, we will maximise the likelihood that these vacancies are filled by local people living within the Freeport area.

Qualifying local start-ups and existing businesses wishing to grow will be able to do so in a competitive environment alongside businesses from further afield, including overseas, who want to establish a presence in our region. Our focus is on business growth, so businesses cannot relocate their existing operation into the Freeport – it really is all about new and growing businesses.

We also have £25m of UK Government funding, which has been matched locally by the public and private sectors, to invest in local infrastructure. This includes improving the continental ferry port at Millbay to support better connectivity with Europe and building a pedestrian/cycle bridge over the A38 dual carriageway to provide residents with an active travel link to two of our employment developments at Langage and Sherford.

Who owns the Plymouth and South Devon Freeport Company?

The PASD Freeport Company is wholly owned by the three Local Authority partners or ‘Members’ – Plymouth City Council, Devon County Council, and South Hams District Council. There is no private sector ownership of the Company whatsoever.

A set of ‘reserved matters’ were agreed by the Local Authority Members when the Company was set up. Decisions that relate to any of these matters must have the unanimous support of all three Local Authority partners.

Schedule 3 on pages 17 to 19 of the Members’ Agreement relating to the Plymouth and South Devon Freeport Limited lists the 41 ‘reserved matters’ that require unanimous Member approval – https://pasdfreeport.com/wp-content/uploads/2023/11/PASDF-Members_Agreement.pdf

The purpose of this is to ensure that big decisions, which could significantly affect the Freeport Company’s direction, structure, or financial health, are not made without the unanimous support of the three Local Authority Members.

Why does the Freeport Outer Boundary include Dartmoor National Park?

The UK Government required Freeport bidders to define an outer boundary in their original bid submission. The purpose of this was to establish a clearly defined space within which the benefits of the Freeport policy (e.g. jobs, skills, investment, and innovation) could be applied and measured. An area that includes many of the people and businesses most likely to experience these benefits was viewed as the best way to achieve this.

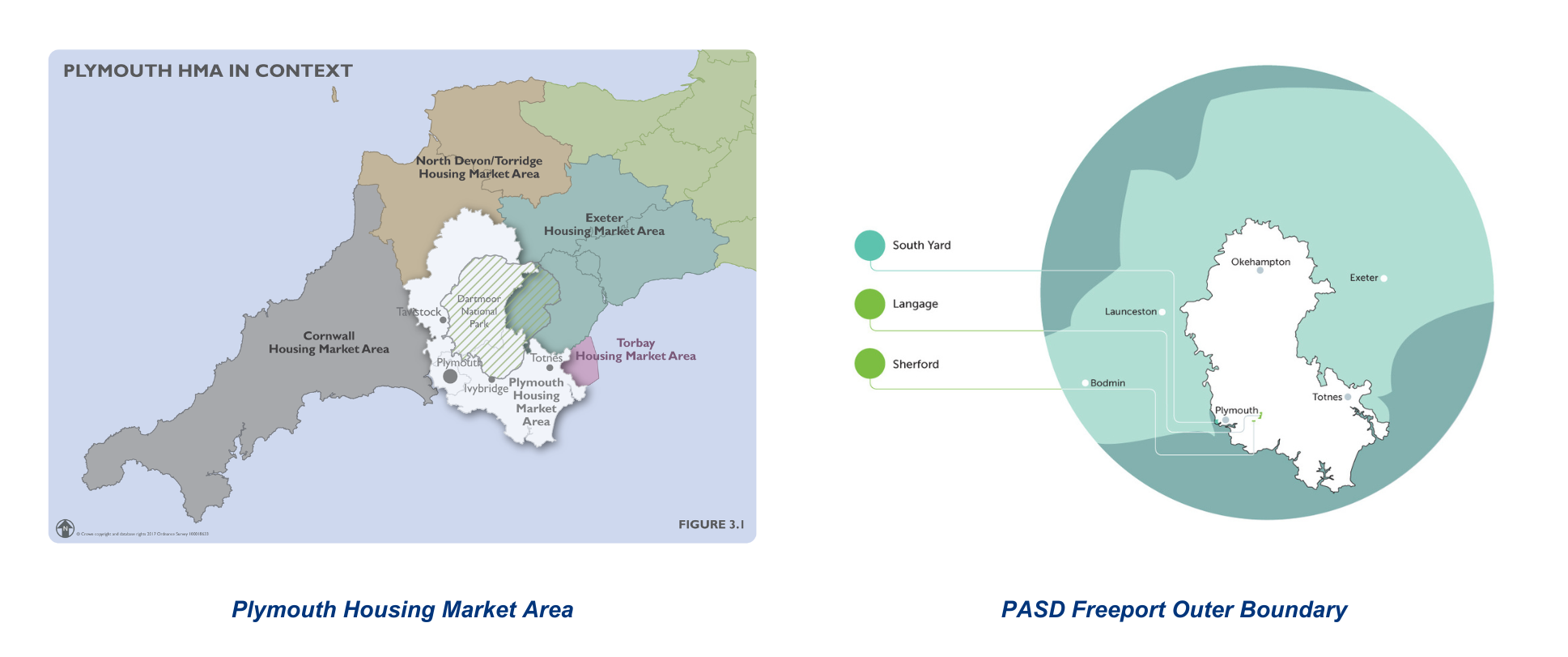

Plymouth and South Devon Freeport’s Outer Boundary is therefore the same as the Plymouth Housing Market Area (HMA). A HMA is a clearly defined space where patterns of demand for housing are monitored. Plymouth’s HMA existed before the Freeport and incorporates the Plymouth, South Hams, and West Devon Council areas. The Plymouth and South West Devon Joint Local Plan (JLP) provides a strategy for the management of economic growth and development within this area (https://plymswdevonplan.co.uk/policy).

All three Tax Sites included in the PASD Freeport bid submission – South Yard, Langage and Sherford – were carefully selected by the local councils with the aim being to encourage investment and appropriate development. These sites are the economic engine of the Freeport and sit within our wider outer boundary which is the much larger area that is expected to benefit most from the Freeport. Tax Sites are strictly designated by HM Treasury and there cannot be more than three in number. Businesses can apply to HMRC for customs site authorisation if their premises are located within one of the three Tax Sites or Outer Boundary.

Importantly, the PASD Freeport Outer Boundary does not give any special planning or regulatory status and does not undermine the special status of protected landscapes such as Dartmoor National Park. The Local Authorities retain all their statutory powers and responsibilities, including responsibility for providing planning permission.

Is the PASD Freeport company a port operator?

No. Associated British Ports (www.abports.co.uk/

Is the PASD Freeport company a landowner?

No. The UK Freeport programme is a Government policy created to accelerate economic growth within a specific area. The PASD Freeport company was established to manage delivery of this economic development policy. As such, the PASD Freeport company works with landowners who own land within the three Freeport Tax Sites at South Yard, Langage, and Sherford, to support their growth plans.

Is the PASD Freeport company a customs site operator?

No. A Freeport is a designated area where goods can be handled under different customs rules. A business wishing to benefit from these rules themselves and/or on behalf of other businesses must first become a customs site operator. This is achieved via a robust application process administered by HMRC – https://www.gov.uk/guidance/apply-to-be-a-freeport-customs-site-operator. If approved, the Freeport customs site operator is responsible for managing the customs procedures within its designated customs site, adhering to strict security and compliance protocols set and monitored by HMRC.

What is the Langage Green Hydrogen Hub and where can I learn more about it?

Langage Green Hydrogen Hub is an industry leading project that will use renewable energy to produce green hydrogen fuel which will help decarbonise industry. The development will have an initial capacity of 10 MW. The project is being delivered by Carlton Power, who have created a project website where people can learn more about this exciting scheme: www.langagegreenhydrogen.co.uk

How was the jobs projection figure reached?

As part of the Full Business Case (FBC) development Government required all Freeports to estimate the number of jobs that would be created and this formed part of the Value for Money assessment.

PASD Freeport’s job projections were based on:

- Growth plans from existing Tax Site tenants, where known.

- Benchmarking – using the Homes and Community Agency’s Employment Density Guide to estimate the number of jobs that could be delivered on the Tax Sites, based on the masterplans that had been developed for them. This is a standard method of estimating potential jobs and is widely used within economic development.

The modelling also included jobs created offsite from the development of an Integrated Logistics Hub on the Sherford Tax Site, freeing up existing space elsewhere in the city, allowing for the creation of new jobs.

Based on the above, the modelling forecast 3,584 direct jobs. This is the number of actual jobs predicted from the development, or ‘gross jobs.’

Government also required the modelling to adjust the gross number of jobs for additionality factors as follows:

- Deadweight – which accounts for what would have been likely to occur on those sites anyway in the absence of the Freeport.

- Displacement – which accounts for the proportion of jobs that that would have been displaced, resulting in a reduction of jobs outside of the target area.

- Leakage – which accounts for jobs that may have been created outside the area as a result of the Freeport.

- Substitution – which accounts for any jobs that a company creates to take advantage of an opportunity (such as a tax incentive) whilst making other job losses.

- Multiplier effects – which accounts for jobs created within the local economy from supply chains and the spending of wages generated as a result of the Freeport’s activity.

This analysis was undertaken based on existing on-site activity and the use of standard industry benchmarks. The adjustments produce an estimate of 3,139 net jobs. This is the number of net additional jobs predicted from the development.

The job predictions are a conservative estimate of what could be created on the footprint of the sites. The actual numbers may be higher or lower in reality depending on site build-out.

The modelling process followed standard procedures recommended by HM Treasury in ‘The Green Book, appraisal and evaluation in central government’.

Contact the Plymouth and South Devon Freeport team