Customs

Plymouth and South Devon Freeport benefits from a range of customs measures, allowing imports to enter our custom sites with simplified customs documentation and delayed payment of tariffs if selling on to the UK market or zero tariffs if selling overseas.

Freeport customs sites are outside UK customs boundaries. This means that goods brought into the Plymouth and South Devon Freeport customs sites are conceptually still ‘off shore’.

This has a number of benefits if you set up a customs site:

- Duty exemption – goods brought into a Freeport customs site can be processed and re-exported without the expense of formally importing them into the UK.

- Duty suspension – goods can be brought into a Freeport customs site and stored in suspense without paying duty to maximise inventory flexibility and cashflow benefit

- Duty inversion – goods assembled in a Freeport customs site and subsequently imported into the UK only attract the duty associated with either the raw materials OR the finished product depending on whichever is lower (this choice is not allowed in some specific circumstances please contact HMRC for further details)

- Businesses operating within Freeport customs sites will also have access to simplified customs arrangements

- Freeport customs benefits reduce costs and make more efficient use of working capital to allow faster growth and more employment.

Plymouth and South Devon Freeport’s Customs Offer

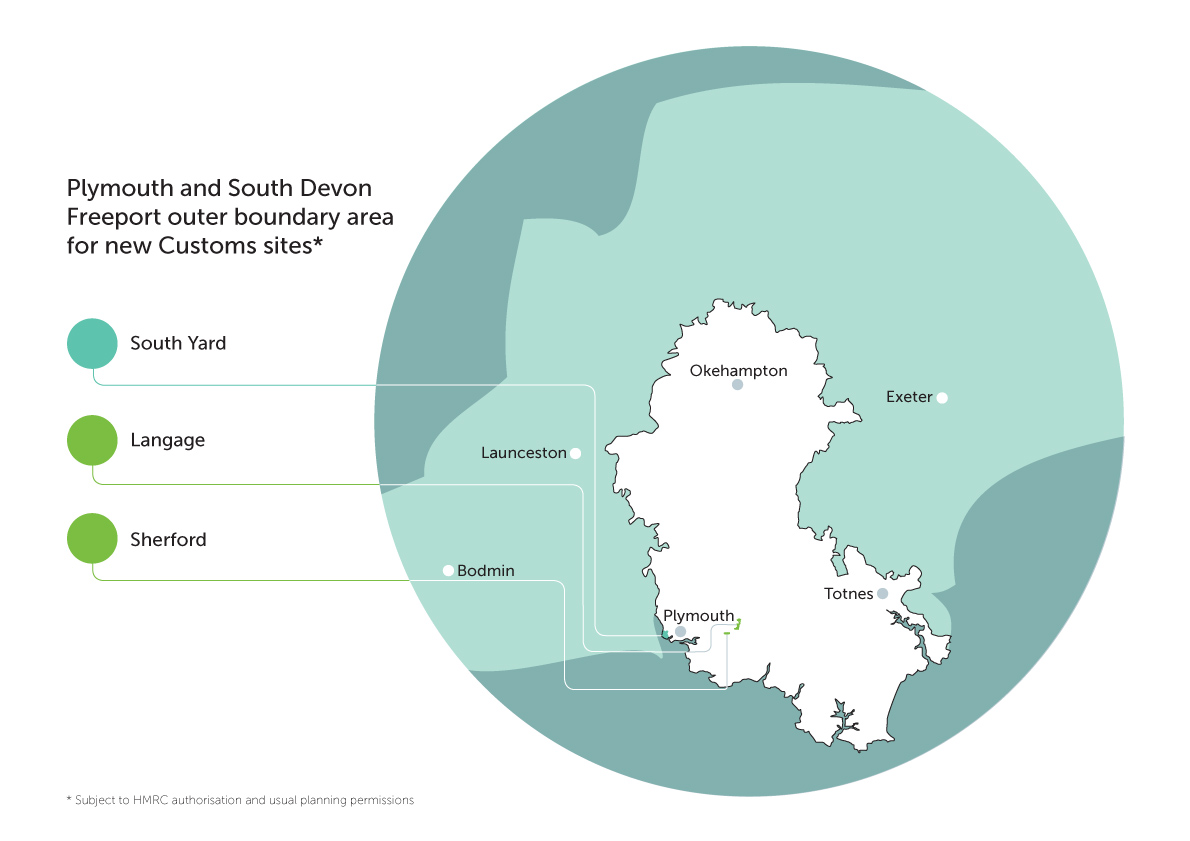

- The PASD Freeport has three designated tax sites at South Yard, Langage and Sherford

- The sites at Langage and Sherford will also include a customs offer (combined tax and customs sites) so benefit from tax incentives and exemptions

- Alongside our two identified combined tax and customs sites, we are able to bring forward additional customs sites now which are situated within the Freeport’s Outer Boundary – subject to the HMRC authorisation process

- Whilst alignment with the Freeport’s key identified target sectors of marine, defence and space with low carbon applications would be advantageous for future potential clustering and supply chain opportunities, it is not a condition of Outer Boundary customs sites that businesses must operate in these sectors to be considered as a customs site operator (CSO)

- The region has a strong local capability in advanced manufacturing; the Freeport is working strategically with key alliances and trade associations including Plymouth Manufacturers’ Group and the Chamber of Commerce to bring on more customs sites

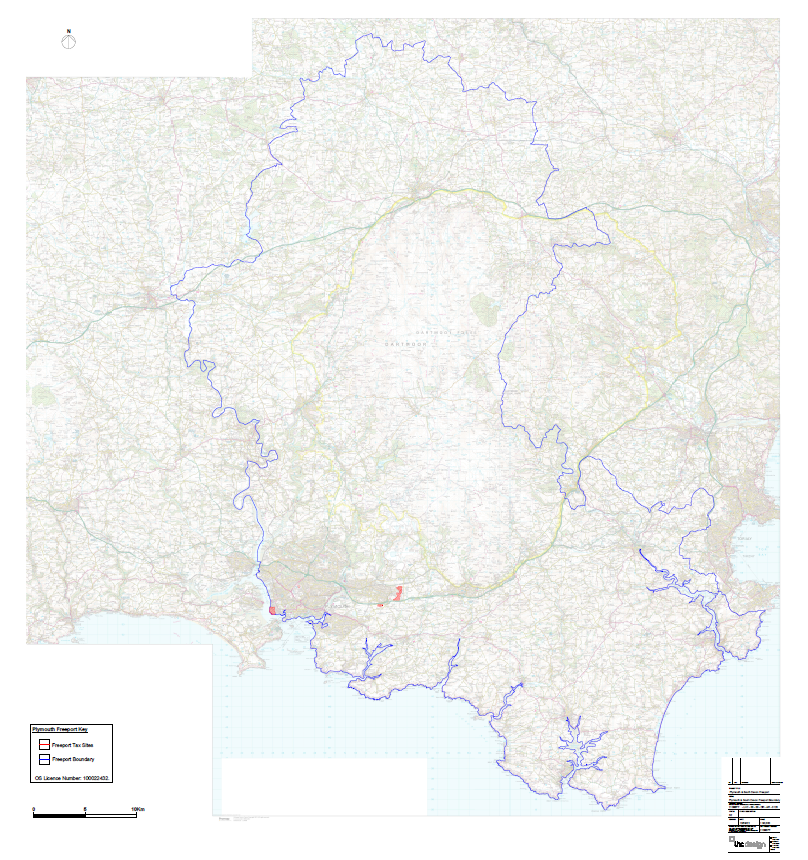

- You can view the Freeport’s outer boundary here

Contact us to discuss how your business could have its own customs site situated within the Freeport’s Outer Boundary.

More information is available on the HMRC webpage – HMRC guidance on customs sites.

- HMRC Freeports induction pack: guidance providing information on the tax and customs measures for businesses interested in operating within a Freeport

- HMRC Freeports business examples: a selection of business user journeys, operating within different sectors and operating models, covering both customs and tax site benefits within a Freeport.

How we will support you:

- Teams call and site visit to assess your business undertaken by a member of our team

- Follow-up consultation with Freeports Hub consultant to input your customs activity into our customs model to identify indicative cost savings and cashflow benefit

- Early stage support with submitting your application(s) to HMRC

- If you’d like to find out more about establishing a customs site for your business please email info@pasdfreeport.com with ‘Customs Enquiry’ in the subject line